Striking-Off a Local Company in Singapore

Striking-Off a Local Company in Singapore

Outline

Striking off a company is a formal process that involves removing a business entity from the official registry maintained by the Accounting and Corporate Regulatory Authority (ACRA) of Singapore. This process is typically chosen by companies that are no longer in operation, have ceased all trading activities, and do not possess any remaining assets or liabilities. Compared to winding up or liquidation, striking off is a streamlined and cost-effective method for closing a business cleanly and legally.

Key Takeaways

- Striking off is a cost-effective way to close a dormant or inactive company in Singapore.

- The process can take at least four months and requires meeting ACRA’s strict eligibility criteria.

- Once struck off, a company can only be restored via court order within six years.

Striking Off vs. Winding Up

Options for Closing a Company in Singapore

In Singapore, business owners have a few options for closing a company: striking off, voluntary winding up, or compulsory winding up. Each route is suited to different business circumstances. Striking off is usually selected by companies that are dormant or inactive, while winding up is reserved for companies that are insolvent or undergoing complex financial or legal situations.

Advantages of Striking Off

Striking off offers significant advantages in terms of simplicity and cost. It does not require the appointment of a liquidator, and there are no court proceedings involved. As a result, companies with minimal activity and no outstanding obligations can opt for striking off as a fast-track way to officially close their business.

Eligibility Requirements for Striking Off

Key Criteria Set by ACRA

However, striking off is not an automatic right and companies must satisfy strict eligibility criteria set by ACRA. First and foremost, the company must have ceased all business operations or must never have commenced operations since incorporation. The company should not have any outstanding debts or liabilities, whether with suppliers, financial institutions, or government bodies.

Legal and Financial Conditions

Additionally, the company must not be involved in any ongoing legal proceedings, either in Singapore or abroad. This is to ensure that all commercial and legal matters have been resolved prior to dissolution. Furthermore, the company should not have any charges registered in its name, and all existing charges must be cleared or released officially.

Tax and Government Obligations

Another important requirement is that the company must not have any outstanding tax obligations. This includes corporate income tax, Goods and Services Tax (GST), and any penalties or fines due to the Inland Revenue Authority of Singapore (IRAS). Similarly, there should be no Central Provident Fund (CPF) contributions owed to employees, and the company must not have any unsettled liabilities with other government agencies.

Shareholder and Accounting Compliance

To proceed with the application, the directors must secure the written consent of the majority of shareholders. This ensures that all stakeholders are informed and in agreement about the decision to strike off the company. In the case of companies with multiple directors or shareholders, this step is essential to prevent potential disputes.

For public companies limited by guarantee, the latest set of audited financial statements must be submitted. For all other companies, an unaudited balance sheet showing that there are no assets or liabilities is sufficient. If the company did have assets or liabilities, it must provide evidence that these have been fully disposed of, settled, or legally waived.

The Application Process

Submitting the Application

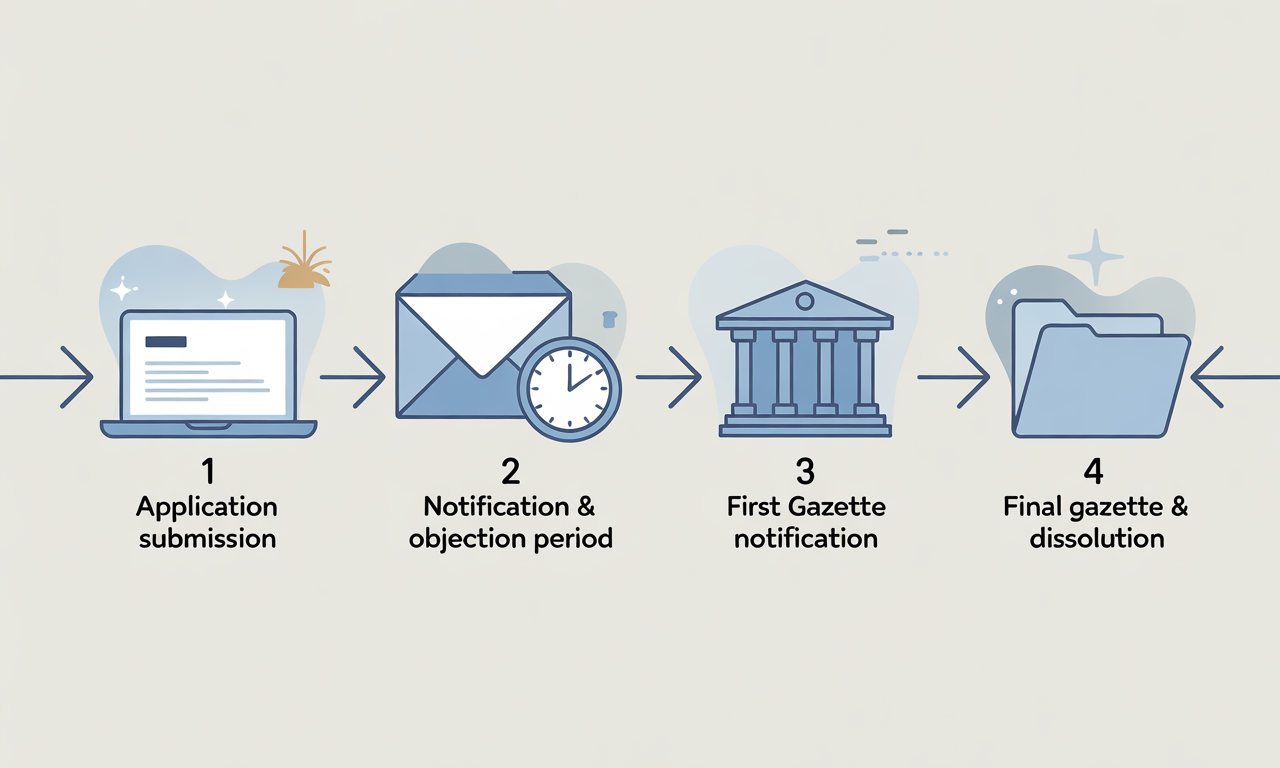

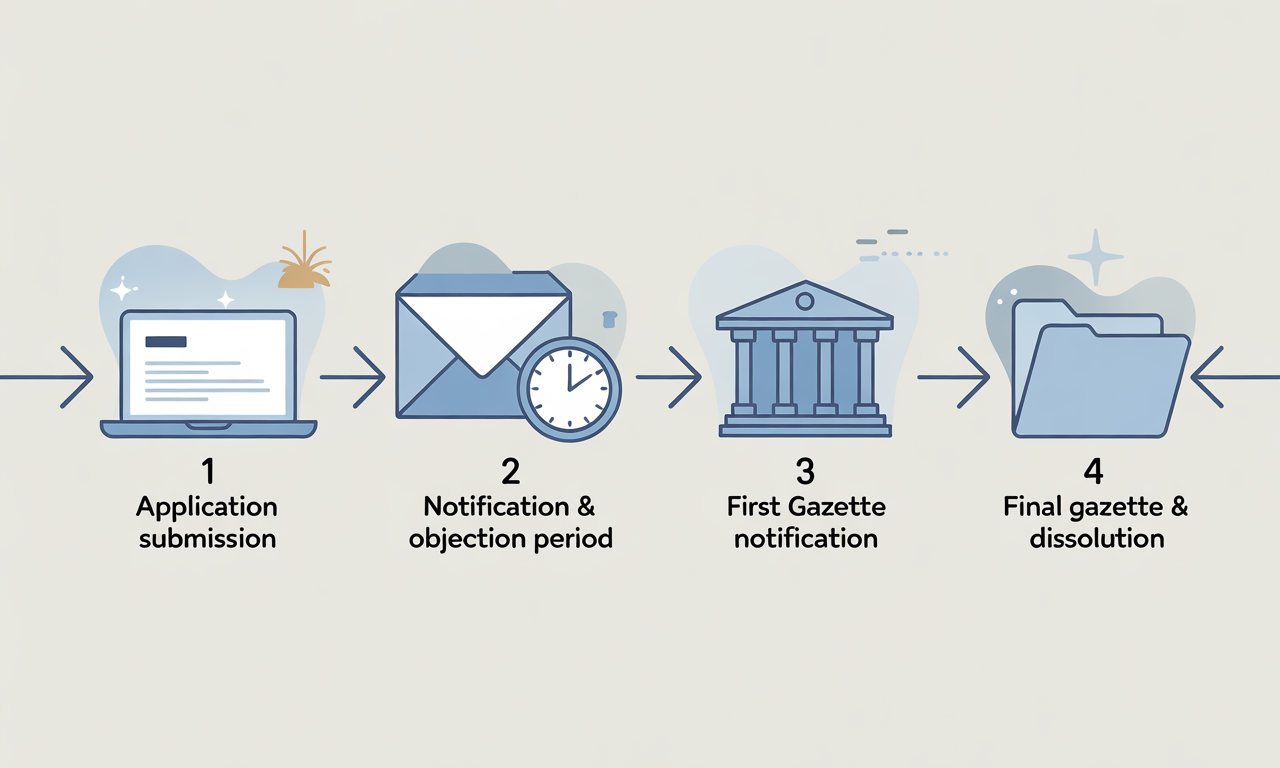

Once all criteria have been met, the application for striking off must be submitted online through ACRA’s BizFile+ portal. The application can be filed by a company director, company secretary, or a registered corporate service provider like Corpzzy. Although there is no government filing fee for the application, it is crucial that the submission is accurate and complete to avoid rejection or delays.

Notification and Gazette Publication

After submission, ACRA will send a notice of the proposed striking off to the company’s registered office and to the residential addresses of all company officers, including directors and the company secretary. Simultaneously, a copy is also sent to the IRAS for their records. This initial notice serves as an opportunity for any objections to be raised. If no objections are raised within 30 days, ACRA will proceed to publish a First Gazette Notification, officially stating its intention to strike off the company. This notification is made public and serves as a final checkpoint for any stakeholders who may wish to object. If no objections are received within the next 60 days, ACRA will issue the Final Gazette Notification and the company will be officially struck off the register.

Handling Objections

Who Can Object and How

It is important to note that anyone can raise an objection to the striking off application. This includes creditors, former employees, or government bodies. If an objection is submitted, the company will be notified and given two months to resolve the issue. Failure to do so will result in the lapse of the application.

Resubmitting After Objections

Should the application lapse, the company must address the cause of the objection before reapplying. This may involve settling debts, resolving legal disputes, or clarifying regulatory concerns. Once resolved, a fresh application for striking off can be made through BizFile+.

After Striking Off

Legal Status and Restoration

After a company has been successfully struck off, it is considered dissolved and no longer legally exists. However, there may be situations where a company needs to be restored, such as in the event of unresolved claims or new business opportunities. Restoration can only be done via a court order, which must be lodged with ACRA within six years from the date of striking off. Once the court order is granted, the application for restoration must be submitted online through BizFile+. Upon approval, the company’s status will be changed from “Struck Off” to “Live”. Restoration is a legal process and may involve legal fees and compliance obligations depending on the case.

How Corpzzy Can Help

Full-Service Compliance Partner

At Corpzzy, we understand that striking off a company can seem complex and time-consuming, especially if you’re unfamiliar with local regulatory requirements. That’s why we offer full-service support for business owners looking to exit their companies smoothly and efficiently. From checking eligibility and preparing documents to filing and follow-ups, our team handles every step on your behalf.

Transparent Pricing and Support

Our all-in-one annual compliance fee includes striking off services for dormant companies, at no extra cost. Whether you are a solo founder, a growing startup, or a holding company looking to close inactive entities, we make the process hassle-free. You can trust Corpzzy to keep you compliant, save time, and avoid penalties.

Responsible Exit Strategy

Striking off a company is not just about closing the books; it’s about protecting your legal and financial standing. Failing to close a dormant or inactive company properly can lead to ongoing compliance obligations, unexpected penalties, and disqualification of directors. Choosing the right partner to assist with the process ensures that you can exit responsibly and confidently. Whether you are restructuring your group of companies, pivoting your business, or simply closing a chapter, striking off offers a clean and efficient exit strategy. Let Corpzzy guide you through it with clarity, compliance, and confidence. Reach out to us to get started today.

Frequently Asked Questions

Questions? We Have Answers

Related Business Articles

Share This Story, Choose Your Platform!

Striking off a company is a formal process that involves removing a business entity from the official registry maintained by the Accounting and Corporate Regulatory Authority (ACRA) of Singapore. This process is typically chosen by companies that are no longer in operation, have ceased all trading activities, and do not possess any remaining assets or liabilities. Compared to winding up or liquidation, striking off is a streamlined and cost-effective method for closing a business cleanly and legally.

Key Takeaways

- Striking off is a cost-effective way to close a dormant or inactive company in Singapore.

- The process can take at least four months and requires meeting ACRA’s strict eligibility criteria.

- Once struck off, a company can only be restored via court order within six years.

Striking Off vs. Winding Up

Options for Closing a Company in Singapore

In Singapore, business owners have a few options for closing a company: striking off, voluntary winding up, or compulsory winding up. Each route is suited to different business circumstances. Striking off is usually selected by companies that are dormant or inactive, while winding up is reserved for companies that are insolvent or undergoing complex financial or legal situations.

Advantages of Striking Off

Striking off offers significant advantages in terms of simplicity and cost. It does not require the appointment of a liquidator, and there are no court proceedings involved. As a result, companies with minimal activity and no outstanding obligations can opt for striking off as a fast-track way to officially close their business.

Eligibility Requirements for Striking Off

Key Criteria Set by ACRA

However, striking off is not an automatic right and companies must satisfy strict eligibility criteria set by ACRA. First and foremost, the company must have ceased all business operations or must never have commenced operations since incorporation. The company should not have any outstanding debts or liabilities, whether with suppliers, financial institutions, or government bodies.

Legal and Financial Conditions

Additionally, the company must not be involved in any ongoing legal proceedings, either in Singapore or abroad. This is to ensure that all commercial and legal matters have been resolved prior to dissolution. Furthermore, the company should not have any charges registered in its name, and all existing charges must be cleared or released officially.

Tax and Government Obligations

Another important requirement is that the company must not have any outstanding tax obligations. This includes corporate income tax, Goods and Services Tax (GST), and any penalties or fines due to the Inland Revenue Authority of Singapore (IRAS). Similarly, there should be no Central Provident Fund (CPF) contributions owed to employees, and the company must not have any unsettled liabilities with other government agencies.

Shareholder and Accounting Compliance

To proceed with the application, the directors must secure the written consent of the majority of shareholders. This ensures that all stakeholders are informed and in agreement about the decision to strike off the company. In the case of companies with multiple directors or shareholders, this step is essential to prevent potential disputes.

For public companies limited by guarantee, the latest set of audited financial statements must be submitted. For all other companies, an unaudited balance sheet showing that there are no assets or liabilities is sufficient. If the company did have assets or liabilities, it must provide evidence that these have been fully disposed of, settled, or legally waived.

The Application Process

Submitting the Application

Once all criteria have been met, the application for striking off must be submitted online through ACRA’s BizFile+ portal. The application can be filed by a company director, company secretary, or a registered corporate service provider like Corpzzy. Although there is no government filing fee for the application, it is crucial that the submission is accurate and complete to avoid rejection or delays.

Notification and Gazette Publication

After submission, ACRA will send a notice of the proposed striking off to the company’s registered office and to the residential addresses of all company officers, including directors and the company secretary. Simultaneously, a copy is also sent to the IRAS for their records. This initial notice serves as an opportunity for any objections to be raised. If no objections are raised within 30 days, ACRA will proceed to publish a First Gazette Notification, officially stating its intention to strike off the company. This notification is made public and serves as a final checkpoint for any stakeholders who may wish to object. If no objections are received within the next 60 days, ACRA will issue the Final Gazette Notification and the company will be officially struck off the register.

Handling Objections

Who Can Object and How

It is important to note that anyone can raise an objection to the striking off application. This includes creditors, former employees, or government bodies. If an objection is submitted, the company will be notified and given two months to resolve the issue. Failure to do so will result in the lapse of the application.

Resubmitting After Objections

Should the application lapse, the company must address the cause of the objection before reapplying. This may involve settling debts, resolving legal disputes, or clarifying regulatory concerns. Once resolved, a fresh application for striking off can be made through BizFile+.

After Striking Off

Legal Status and Restoration

After a company has been successfully struck off, it is considered dissolved and no longer legally exists. However, there may be situations where a company needs to be restored, such as in the event of unresolved claims or new business opportunities. Restoration can only be done via a court order, which must be lodged with ACRA within six years from the date of striking off. Once the court order is granted, the application for restoration must be submitted online through BizFile+. Upon approval, the company’s status will be changed from “Struck Off” to “Live”. Restoration is a legal process and may involve legal fees and compliance obligations depending on the case.

How Corpzzy Can Help

Full-Service Compliance Partner

At Corpzzy, we understand that striking off a company can seem complex and time-consuming, especially if you’re unfamiliar with local regulatory requirements. That’s why we offer full-service support for business owners looking to exit their companies smoothly and efficiently. From checking eligibility and preparing documents to filing and follow-ups, our team handles every step on your behalf.

Transparent Pricing and Support

Our all-in-one annual compliance fee includes striking off services for dormant companies, at no extra cost. Whether you are a solo founder, a growing startup, or a holding company looking to close inactive entities, we make the process hassle-free. You can trust Corpzzy to keep you compliant, save time, and avoid penalties.

Responsible Exit Strategy

Striking off a company is not just about closing the books; it’s about protecting your legal and financial standing. Failing to close a dormant or inactive company properly can lead to ongoing compliance obligations, unexpected penalties, and disqualification of directors. Choosing the right partner to assist with the process ensures that you can exit responsibly and confidently. Whether you are restructuring your group of companies, pivoting your business, or simply closing a chapter, striking off offers a clean and efficient exit strategy. Let Corpzzy guide you through it with clarity, compliance, and confidence. Reach out to us to get started today.

Frequently Asked Questions

Questions? We Have Answers

Share This Story, Choose Your Platform!