Guides

Our Guides

Our Guides

Singapore’s YA 2025 tax support package offers businesses up to S$40,000 through a 50% Corporate Income Tax Rebate and a cash grant for companies that hired a local employee in 2024. This comprehensive guide explains how these benefits work, who qualifies, and how your company can maximise every dollar.

Stay ahead of the curve with the latest updates on Singapore’s BCA Builder’s Licence and Contractors Registration System (CRS). This guide covers the 2025 changes to licensing requirements, including mandatory registration for foreign worker hiring and increased capital thresholds.

Singapore’s Central Registers of Nominee Directors and Nominee Shareholders require companies and foreign companies to file detailed information about nominee directors and shareholders with ACRA. These updates enhance corporate transparency while keeping sensitive nominator details accessible only to law enforcement agencies.

Blogs

Our Blogs

Our Blogs

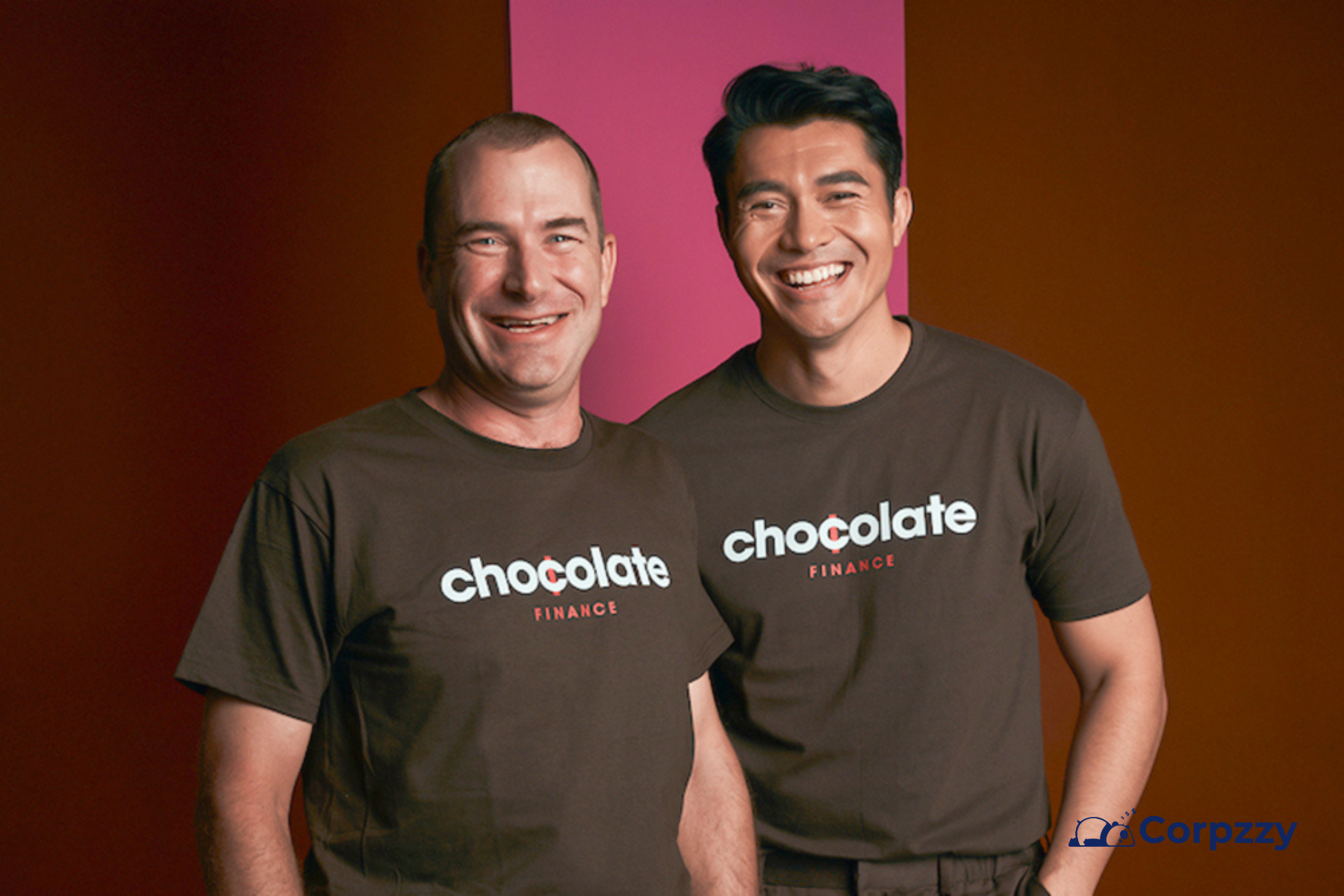

Chocolate Finance’s suspension of instant withdrawals has sparked concerns about liquidity and financial risks. While the company denies issues, users are questioning the sustainability of its high-yield model and whether their funds are truly safe.

Starting an online business in 2024 offers Gen Z a low-risk, high-reward way to achieve financial independence, with options like freelancing, print-on-demand, digital products, and subscription boxes. This guide explores ten profitable business ideas, the best legal structures for each, and how to turn a side hustle into a fully incorporated venture.